Halloween Storm Causes Over $250 Million in Insured Damage

The Halloween storm that hit Eastern Canada between October 30 and November 1, 2019 caused over $250 million in insured damage, according to Catastrophe Indices…

The Halloween storm that hit Eastern Canada between October 30 and November 1, 2019 caused over $250 million in insured damage, according to Catastrophe Indices…

The Intact Financial Corporation is investing $1 million in charities that are developing practical and effective solutions that help protect people from natural disasters like floods, wildfires,…

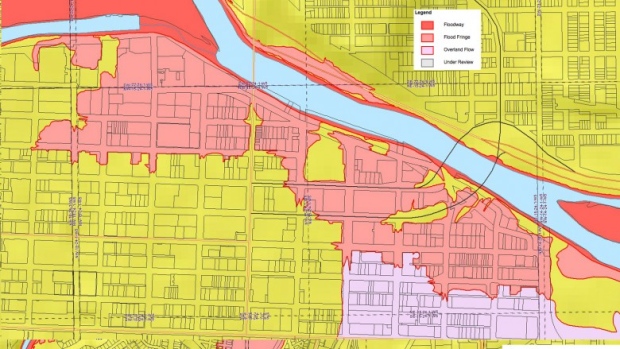

The Insurance Bureau of Canada (IBC) has released a paper that provides Options for Managing the Flood Costs of Canada’s Highest Risk Residential Properties. In…

The winter storm that hit Ontario, Quebec, New Brunswick, and Nova Scotia in March 2019 caused over $124 million in insured damage, according to Catastrophe…

It doesn’t take much convincing to believe that flooding is a big problem in Canadian communities. The insurance industry has been sounding the alarm for…

On August 8th, a thunderstorm produced 72 millimeters of rain over Toronto, with 51 millimeters falling in just one hour. The Insurance Bureau of Canada…

Insurance Bureau of Canada (IBC) has joined the Intact Centre on Climate Adaptation at the University of Waterloo and the City of Toronto to launch a pilot Toronto Home…

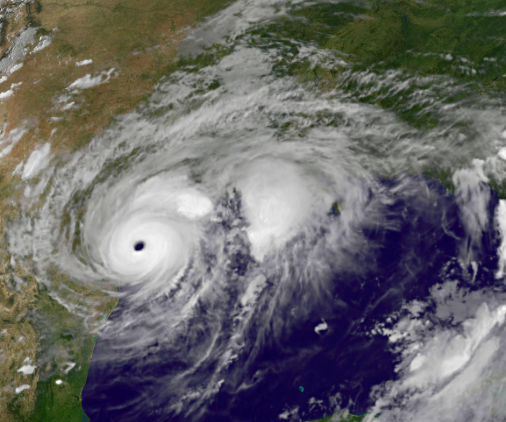

Scientists have developed a detailed analysis of how 22 recent hurricanes would be different if they formed under the conditions predicted for the late 21st…

Guelph, Ontario-based insurance and investment co-operative, The Co-operators, has announced the addition of storm surge coverage to its Comprehensive Water product. Waves caused by storms…

Following on last week’s announcement from the Insurance Bureau of Canada (IBC) regarding Atlantic Canada flooding, the IBC has released an online tool to increase…

The Town of Minto, Ontario, population 8,300, experienced a significant rainfall event during the early morning hours of June 23, 2017. The rainfall resulted in…

The Institute for Catastrophic Loss Reduction reports that better coordination and enforcement of municipal efforts to curb private lot flood risk is needed. The report,…

The Insurance Bureau of Canada has released a statement on flooding and insurance coverage in the province of Quebec. The statement is in response to…

When Water Canada published a story on the top seven water stories for 2016, the authors highlighted the federal government’s commitment to new funds for…

British Columbia has announced that Disaster Financial Assistance (DFA) is now available to eligible British Columbians in the central region who may have been impacted…

The City of Markham, Ontario, has urged the insurance industry to consider city flood control measures when setting home insurance rates. Over the past three…

Alert Labs Inc., designer of the Flowie water sensor and Floodie companion sensor, which help to protect homes from flood damage and to provide minute-by-minute…

In Canada, overland flooding costs the Canadian economy more than any other kind of natural hazard. It is the single largest draw on the Disaster…

A report from the CBC has brought to a light a poll conducted on behalf of Public Safety Canada in summer 2016, which found that…

From the wildfires that swept through Fort McMurray in May to the floods that devastated parts of Nova Scotia and Newfoundland over Thanksgiving weekend, severe…

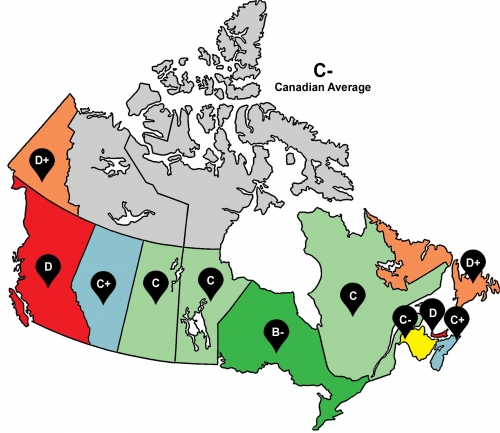

A new report from the Intact Centre on Climate Adaptation out of the University of Waterloo finds all 10 provinces and Yukon are ill-prepared for flooding as…

The agreement will allow the NFIP to share flood risk with private reinsurance companies to help defray the cost of claims from large and unexpected insured events, such as large hurricanes, ultimately strengthening the NFIP’s solvency and lessening the burden on taxpayers, according to background information from Munich Re.

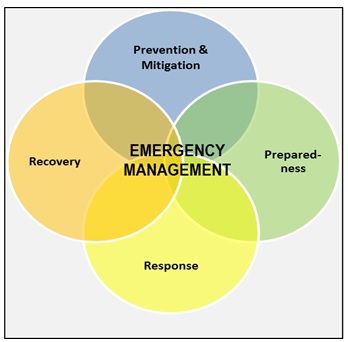

At a multi-stakeholder roundtable discussion, it was agreed that to improve our flood resiliency, Canadians needed the following conditions to be in place: Canadians understand the risk that overland and urban flood presents to their homes, business and communities

The federal, provincial and territorial governments have developed a resource, the Emergency Management Framework for Agriculture, to improve Canada’s ability to address risks and emergencies, from prevention…