The global fashion and textiles industry is largely blind to the risks of water pollution and is failing to tap into water-related business opportunities, according to a new report published by CDP.

CDP research shows the sector’s level of awareness and transparency is low. This is despite the fact that companies are increasingly facing material risks from water pollution, including regulatory penalties, losing the social license to operate, and damaged brand image.

“The pressure is mounting for fast fashion to clean up its act when it comes to water pollution,” said Cate Lamb, director of water security at CDP. “Investors, regulators, customers, and consumers alike are all calling for change.”

“The industry was hit hard by the COVID-19 crisis this year, and the temptation will be there to prioritize short term gains,” added Lamb. “But the road to a resilient recovery lies in embracing sustainability and circular economy practices. This is the direction of travel and the companies leading the way will be best prepared for the future.”

The report—Interwoven Risks, Untapped Opportunities—analyzes data from 62 companies (brands, manufacturers, and retailers) involved in the fashion/apparel, footwear, and home textiles industry. The companies include Adidas AG, Burberry, Gap Inc, H&M, Inditex, and Kering Group. These 62 companies disclosed through CDP’s water security questionnaire in 2019, at the request of investors and corporate customers.

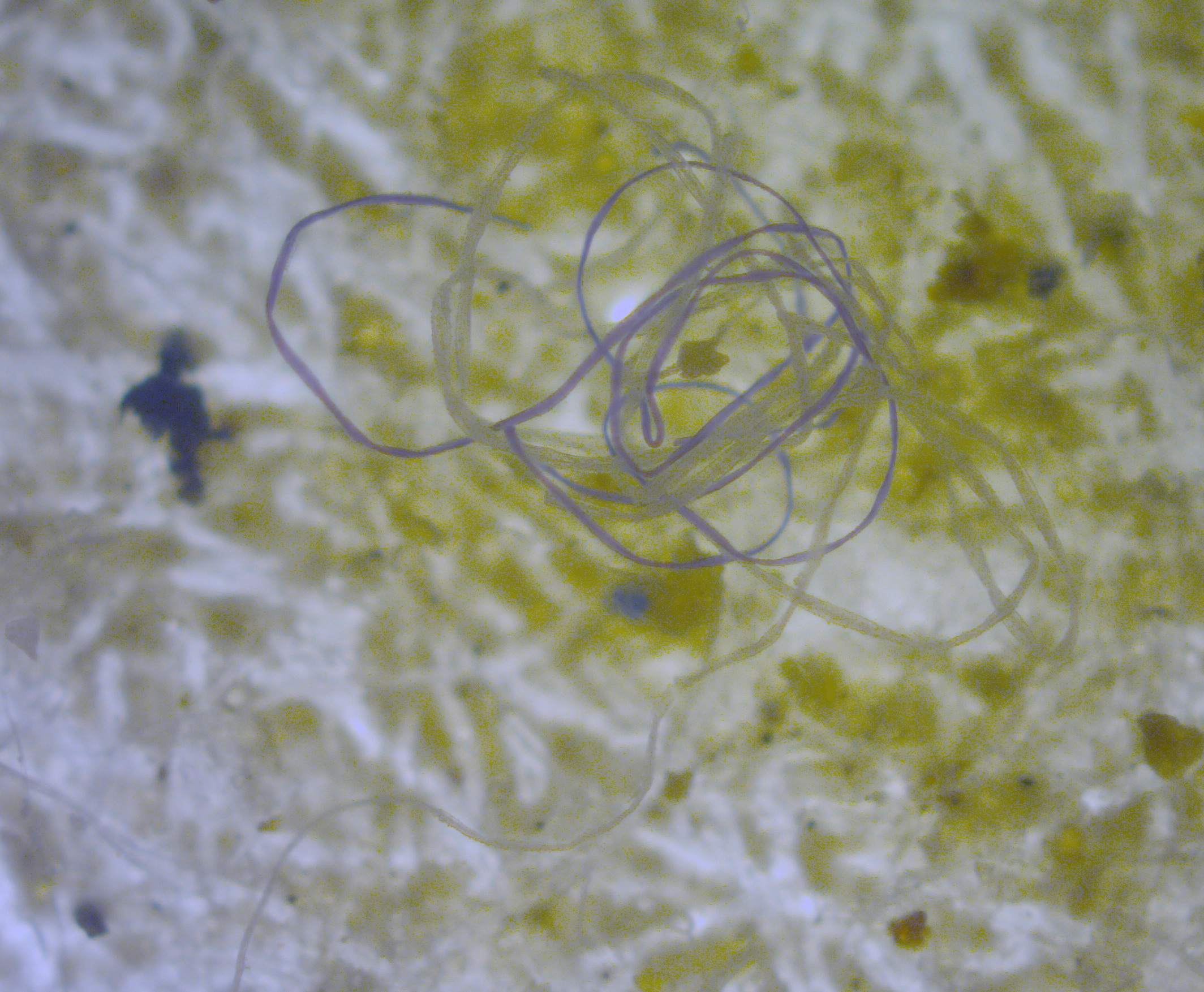

CDP’s analysis found the majority of substantive pollution risks reported by these companies were identified in the manufacturing stages of their value chain. Very few substantive risks were reported in other parts of the value chain known to have a high pollution potential. In fact, only around one in 10 (11 per cent) even acknowledge that product use and disposal can also contribute to water pollution, and not a single company considers pollution at this stage of the value chain to be a substantive financial or strategic risk.

This 11 per cent that shows awareness of water pollution across all stages of the value chain is represented by just seven risk-aware companies: high-street fashion giants Gap Inc, H&M, and Inditex (the biggest fashion group in the world and owner of Zara). They are joined by luxury fashion houses Burberry and Kering Group (owner of Gucci and Saint Laurent), American multinational clothing firm Hanesbrands Inc, and South Africa-based multinational retailer Woolworths Holdings Ltd.

“Water is a business-critical issue for the apparel industry, and we recognize its importance across our value chain,” said Agata Smeets, director of supply chain sustainability at Gap Inc. “We must focus not only on reducing water consumption in our manufacturing operations, which we started tackling with our water reduction goal, but also in raw material cultivation and customer product water use.”

“Water pollution is one of the six environmental impacts covered by Kering’s Environmental Profit & Loss account for nearly 10 years,” added Marie-Claire Daveu, chief sustainability officer and head of international institutional affairs at Kering Group. “Because of the large amounts of water used by tanneries, special wastewater treatment measures are required: we have been working with our suppliers to improve processes, and implement programs to protect the environment all along our supply chain.”

Despite the data being reported in 2019, when public concern about plastic waste was at an all-time high, H&M was the only reporting company to mention microplastics or microfibers in its disclosure.