In 2017, U.S. industry spent $10.2 billion on water management, including water acquisition, treatment, reuse, and discharge, according to Bluefield Research.

In its latest report, Opportunities in U.S. Industrial Water: Market Size, Trends, and Forecast, 2018–2022, Bluefield analyzes water management spend across twenty water-intensive industries that cover oil & gas, chemicals, power, food and beverage, and light and heavy manufacturing.

Overall, water use in the United States is estimated at 322 billion gallons per day, with manufacturing, mining, oil and gas, and power accounting for 47 per cent of total withdrawals. According to Bluefield’s report, industrial sector withdrawals have steadily declined 30 per cent over the last three decades.

“It is evident overall water use for industrials is declining, but that’s only part of the story,” said Mike Kozar, senior analyst for Bluefield Research. “While withdrawals are shrinking through technology improvements and an evolving U.S. industrial footprint, the allocation of water spend from acquisition to reuse is changing within this smaller pie.”

For water solutions providers, industrial demand for improved water management presents significant opportunities. Facing a changing regulatory environment, emerging climate risks, and a need for access to reliable water supplies, companies are deploying new technologies and strategies to better address their water footprints.

Water demands vary significantly across a highly fragmented industrial sector in terms of treatment needs, effluent strength, water intensity, geographic consolidation, and segment growth, according to Bluefield’s report. Food manufacturing, which makes up 10 per cent of the annual total, is highly fragmented across U.S. states and requires more commoditized solutions, such as filters and mobile treatment systems.

At the same time, a more mature, slower moving downstream oil segment that is limited to approximately 140 refineries in a limited number of states, call for heavily customized treatment systems capable of handling hundreds of thousands of gallons of effluent per day.

“Our analysis of more than 300,000 facilities in more than 3,000 counties highlights the extreme geographic and demand-side variations across the industrial sector,” said Mike Kozar. “Our goal was to break down which industries, segments, and regions offer the most opportunities for water service providers now and going forward.”

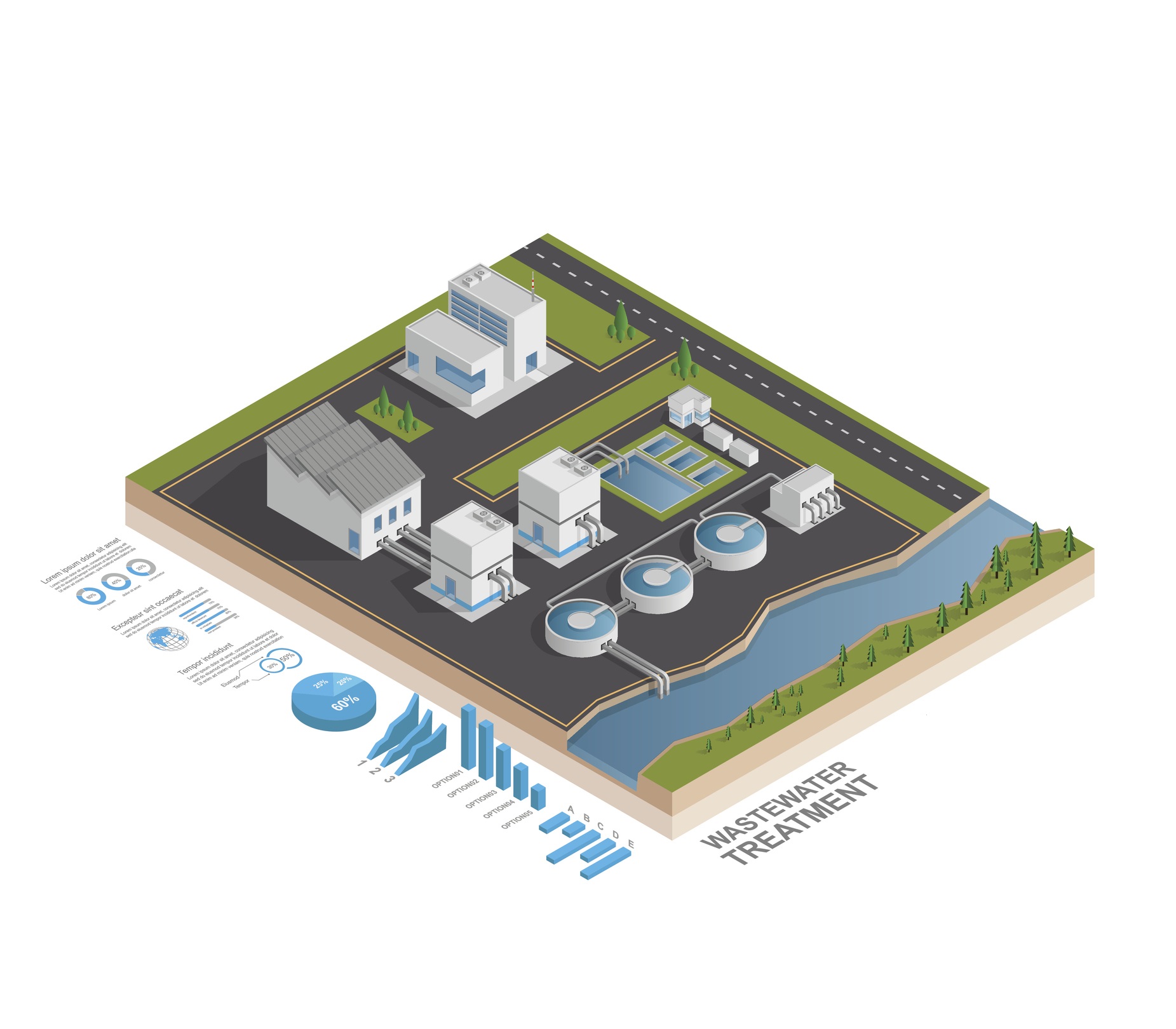

Bluefield’s analysis identifies wastewater reuse as a key focus of change. To make greater strides in this area and improved efficiencies, decentralized treatment systems, digital monitoring, and alternative water sources are expected to grow in adoption. While federal EPA and state regulations pose longer-term drivers, the pace of regulatory change is having less of an impact than bottom-line driven solutions, found Bluefield.

“Private, financially driven industrial firms are often considered to be prized opportunities by water solutions providers,” said Kozar. “The challenge is navigating a highly fragmented landscape, both geographically and by client need. We think this report is a perfect guide to hone one’s strategy.”